In the course of the 16th century, Venice produced the theoretical accounting science by the writings of Luca Pacioli, Domenico Manzoni, Bartolomeo Fontana, the accountant Alvise Casanova and the erudite Giovanni Antonio Tagliente.īenedetto Cotrugli (Benedikt Kotruljević), a Ragusan merchant and ambassador to Naples, described double-entry bookkeeping in his treatise Della mercatura e del mercante perfetto. Before this there may have been systems of accounting records on multiple books which, however, do not yet have the formal and methodical rigor necessary to control the business economy. The double-entry system began to propagate for practice in Italian merchant cities during the 14th century. Some sources suggest that Giovanni di Bicci de' Medici introduced this method for the Medici bank in the 14th century, though evidence for this is lacking. Giovannino Farolfi & Company, a firm of Florentine merchants headquartered in Nîmes, acted as moneylenders to the Archbishop of Arles, their most important customer.

#BRIEF HISTORY OF DOUBLE ENTRY BOOKKEEPING FULL#

Manucci was employed by the Farolfi firm and the firm's ledger of 1299–1300 evidences full double-entry bookkeeping. The earliest extant accounting records that follow the modern double-entry system in Europe come from Amatino Manucci, a Florentine merchant at the end of the 13th century. (However, satisfying the equation does not necessarily guarantee a lack of errors, for example, the wrong accounts could have been debited or credited.) The accounting equation serves as an error detection tool if at any point the sum of debits for all accounts does not equal the corresponding sum of credits for all accounts, an error has occurred. The basic entry to record this transaction in a general ledger will look like this:ĭouble-entry bookkeeping is based on "balancing" the books, that is to say, satisfying the accounting equation.

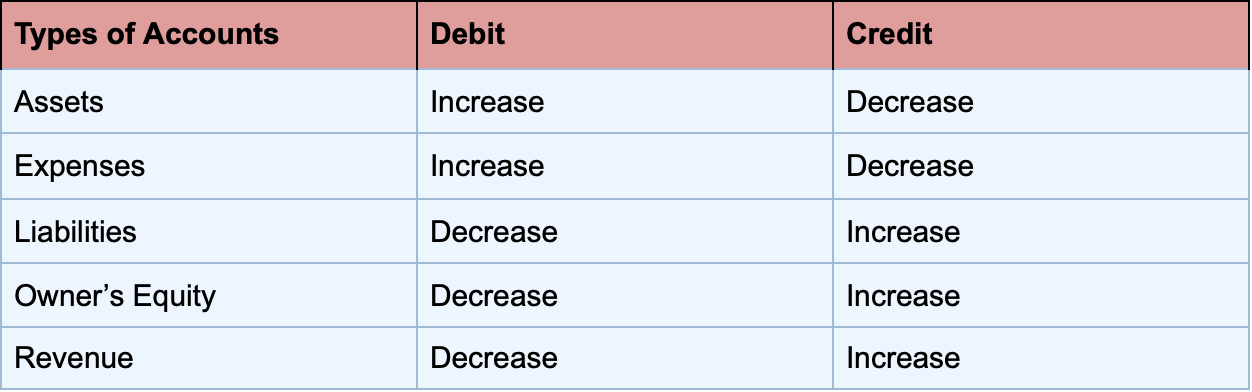

The purpose of double-entry bookkeeping is to allow the detection of financial errors and fraud.įor example, if a business takes out a bank loan for $10,000, recording the transaction would require a debit of $10,000 to an asset account called "Cash", as well as a credit of $10,000 to a liability account called "Loan Payable". A transaction in double-entry bookkeeping always affects at least two accounts, always includes at least one debit and one credit, and always has total debits and total credits that are equal. The double-entry system has two equal and corresponding sides known as debit and credit. Every entry to an account requires a corresponding and opposite entry to a different account. Double-entry bookkeeping, also known as double-entry accounting, is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information.

0 kommentar(er)

0 kommentar(er)